how to change how much taxes are taken out of paycheck

The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their pay. Heres a breakdown of the different paycheck taxes and why they sometimes change.

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

IR-2019-178 Get Ready for Taxes.

. Any of these far-reaching changes could affect refund amounts. With each paycheck youll see money taken out for taxes. The Withholding Form.

The percentage can vary based on a variety of factors and it gets even more complicated now that the income tax brackets have changed. Your Form W-4 determines how much your employer withholds. See the different requirements for both employers and employees for 2022.

The employers portion of both taxes is deductible on your Federal income tax return which can help to offset the sting of paying both parts of the Social Security and Medicare taxes. Medicare tax is levied on all of your earnings with no. Contributions to a 401k are pretax meaning they are deposited before your income taxes are deducted from your paycheck.

You should fill out a new form every time you start a new job or make a life change like getting married or adopting a child. Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return. Fastest federal tax refund with e-file and direct deposit.

Some of it also goes to FICA taxes which pay for Medicare and Social Security. So the right amount of taxes are withheld from your paycheck for as much of the year as possible. Our free W4 calculator allows you to enter your tax information and adjust your paycheck withholding to increase your refund or take-home pay on each paycheck by show you how to fill out your 2020 W 4 Form.

Adjust your W-4 withholdings to get a bigger tax refund or a bigger paycheck. Want 10 taken out every time. Hopefully this guide and collection of W-4.

It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA. Adjusting your pre-tax contributions can also affect how much taxes are withheld. The IRS issues more than 9.

Check your paystub and use a W-4 Calculator to find out if you need to make any changes to your federal income tax withholding this year. The new Form W-4 doesnt have to be confusing. However when in retirement withdrawals are taxed at your then-current.

The percentage rate for the Medicare tax is 145 percent although Congress can change it. Federal Tax Withholding. Learn how to fill out a W-4 form with this updated in depth guide for 2022.

But the IRS introduced a new Form W-4 beginning with the tax year 2020 that can simplify the process a bit. If youre expecting a big refund this year you may want to adjust your withholding to have. Get ready today to file 2019 federal income tax returns.

A W-4 is a standard form published by the IRS that lets you tell your employer how much money you want to be taken out of your paycheck each pay period. Taxes taken out of your paycheck. The TCJA eliminated the personal exemption.

Tax refund time frames will vary. It might seem like youre going to be getting smaller paychecks but youre simply paying the taxes you owe in advance so you wont be surprised with a large tax bill later. All features services support prices offers terms and conditions are subject to change without notice.

Pre-tax contributions change how. Maximize your refund with TaxActs Refund Booster. The IRS applies these taxes toward your annual income taxes.

Payroll Deductions As Liabilities Vs Payroll Expenses

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

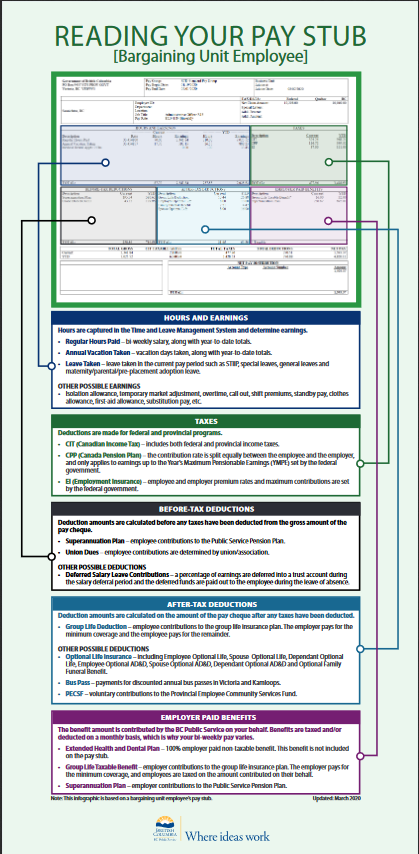

How To Read Your Pay Stub Province Of British Columbia

Irs New Tax Withholding Tables

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Taxes On Paycheck On Sale 52 Off Www Ingeniovirtual Com

Different Types Of Payroll Deductions Gusto

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

How Does A Paycheck Look Like In Canada What Are The Deductions Quora

What Are Payroll Deductions Article

Paycheck Calculator Online For Per Pay Period Create W 4

Decoding Your Paystub In 2022 Entertainment Partners

Taxes On Paycheck On Sale 52 Off Www Ingeniovirtual Com

Solved What Is The Purpose Of Extra Withholding Under The State Section Of The Employee Taxes

How To Read A Pay Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Understanding Your Paycheck Credit Com

Free Online Paycheck Calculator Calculate Take Home Pay 2022